Market

How Solana Fueled a 66% Surge in Pantera Capital’s Fund

[ad_1]

Pantera Capital has reported a remarkable 66% growth in its crypto fund during the first quarter of the year.

Notably, Pantera’s Liquid Token Fund increase coincides with Solana’s performance, which saw a 99% price increase in Q1.

How Solana Aided Pantera Capital’s Growth

The fund is now valued at around $300 million. This can be attributed to a strategic shift in investment focus. It reduced exposure to digital assets tied to Bitcoin and Ethereum. Instead, the firm opted to emphasize Solana and other altcoins such as Ribbon Finance, Aevo, and Stacks.

Cosmo Jiang, Pantera Capital’s portfolio manager, outlined the reasoning behind this pivot. He noted challenges for Ethereum-linked tokens, citing reduced odds of Ethereum exchange-traded funds (ETFs) approval. Despite Bitcoin’s first-quarter surge of 67% to a new all-time high above $70,000, the firm slashed its holdings by over half to invest in other promising projects.

Pantera Capital’s successful investment in Solana comes as no surprise, having acquired SOL tokens at a significant discount from the bankrupt FTX exchange. BeInCrypto reported that FTX sold 30 million SOL at $64 to VC firms like Pantera Capital and Galaxy Trading. However, these tokens are subject to a four-year lock-up period.

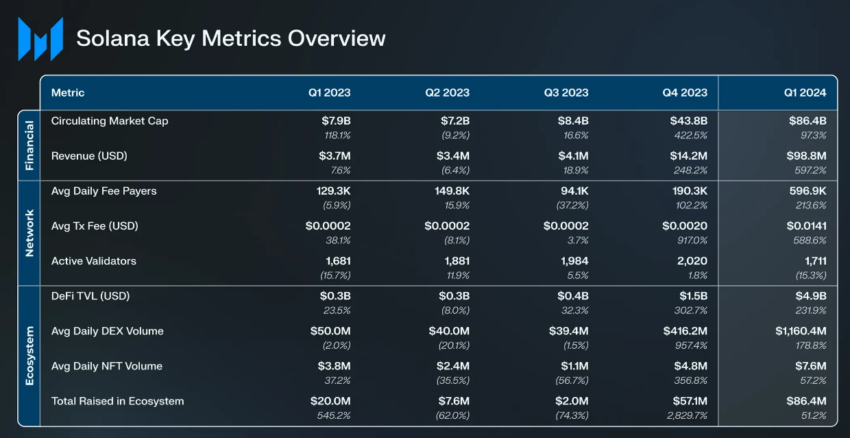

Despite a brief outage on Solana in February, its exceptional performance in the first quarter is noteworthy. SOL’s price surged by approximately 99%, hitting a three-year high of over $200, propelling its market capitalization to an all-time high.

Read more: 6 Best Platforms To Buy Solana (SOL) in 2024

Solana also emerged as a hub for memecoins, fostering a thriving ecosystem that propelled the network’s average daily spot volume on decentralized exchanges up by 319% to $1.5 billion. Furthermore, Solana-based projects raised $89.2 million in the first quarter, indicating a significant uptick compared to total funding for last year.

“Solana also took strides in its ability to support institutions with the launch of token extensions, which enable a set of configurable features for token issuers. However, the increased network activity led to congestion issues, which are being addressed in upcoming networking, scheduler, and fee market upgrades,” analyst at Messari afformed.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link