Bitcoin

Iran’s Attack on Israel Sparks $962.40 Million Crypto Market Crash

[ad_1]

On April 13, the cryptocurrency market witnessed a substantial downturn, marked by a nearly 10% drop in Bitcoin and other digital currencies.

This decline was instigated by heightened geopolitical tensions in the Middle East, particularly Iran’s attack on Israel.

Iran’s Attack Spurs Crypto Market Decline

The crypto market experienced a significant price crash, with several altcoins plunging by double digits in response to Iran’s actions. Bitcoin, for instance, saw a rapid decline of $6,000 within minutes of the attack, as the flagship digital asset tumbled from around $68,000 to as low as $60,800 before rebounding to $64,400 at the time of reporting.

Similarly, Ethereum dropped from around $3,200 to $2,800 before recovering to $3,000. Other assets such as BNB, Solana, and Dogecoin also experienced declines of 5%, 8%, and 10% respectively over the past 24 hours.

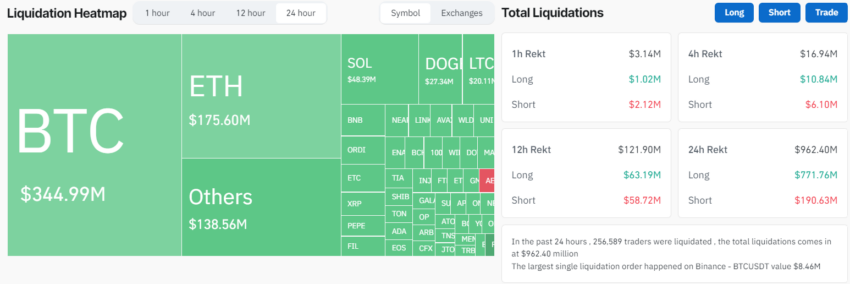

These developments resulted in significant losses for traders. Data from Coinglass reveals that approximately $962.40 million was lost, predominantly by bullish position holders who suffered losses of $771.76 million. In comparison, short traders incurred losses of $199.63 million due to the market downturn.

Furthermore, the DeFi sector witnessed liquidations exceeding $120 million, marking the highest point of liquidations this year, as per Parsec data.

Analyst at QCP Capital attributed the widespread sell-off to Bitcoin’s role as a weekend proxy macro hedge, exposing it to the full impact of immediate risk-off reactions. The firm noted that this situation presents an opportunity for traders to buy the dip, citing historical profitability in such scenarios during major geopolitical conflicts.

Read more: Bitcoin Price Prediction 2024/2025/2030

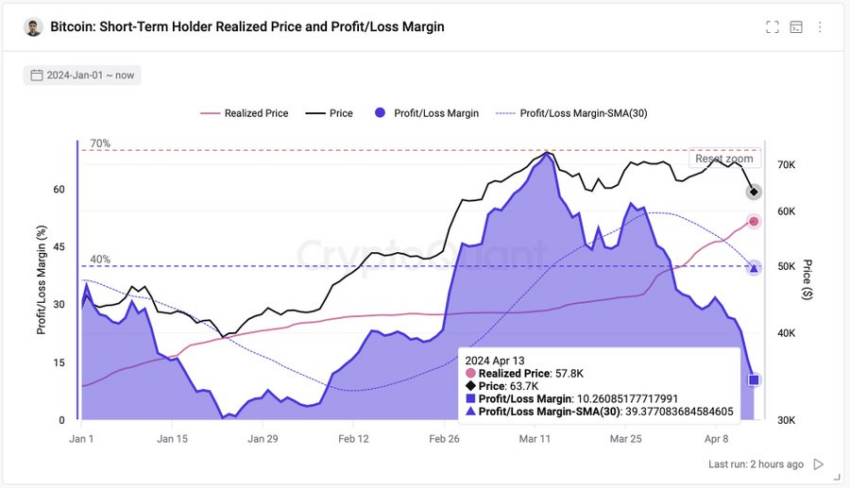

Meanwhile, Julio Moreno, head of research at CryptoQuant, highlighted that the sell-off reset traders’ unrealized profits to zero, which typically signals a bottom in bull markets.

“After today’s sell-off, traders’ unrealized profits (purple area) are at the lowest since early February (10%). Moreover, prices are nearer to the trader’s realized price of $58,000,” Moreno added.

Still, tensions in the Middle East remain high, with Iran issuing warnings of further attacks if Israel retaliates against its drone strikes. Notably, the heavily sanctioned country stated that it considered the matter concluded but cautioned of more severe responses if Israel makes another “mistake.”

“Iran’s military action was in response to the Zionist regime’s aggression against our diplomatic premises in Damascus. The matter can be deemed concluded. However, should the Israeli regime make another mistake, Iran’s response will be considerably more severe. It is a conflict between Iran and the rogue Israeli regime, from which the US must stay away!,” Permanent Mission of the Islamic Republic of Iran to the United Nations wrote.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link