Market

Momentum for Further All-Time Highs

[ad_1]

PEPE, the third biggest memecoin in the market cap, behind just DOGE and SHIB, grew by almost 800% in the last month. The frog coin is now almost topping the $3B market cap.

Despite all this growth, can this trend continue? On-chain and Technical Analysis shows us that PEPE price could soon reach new all-time highs.

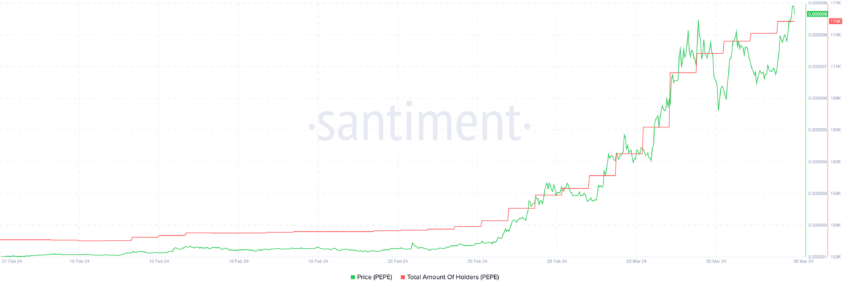

PEPE Gained More Than 25,000 Holders

The recent spike in PEPE holder base by over 25,000 within two weeks speaks volumes about the growing trust in the currency. This influx of new investors serves as a solid foundation for sustained upward price pressure.

It’s interesting to note that this growth trend doesn’t seem to be slowing down, so one could expect the number of PEPE holders growing even more in the coming days.

Holders

PEPE had roughly 150,000 holders on February 6. On March 8, its number of holders had jumped to 175,000. A token that large amassing a 16% growth in holders in less than 2 weeks is impressive.

The last time PEPE attracted so many holders in a short span of time, its price doubled in 15 days.

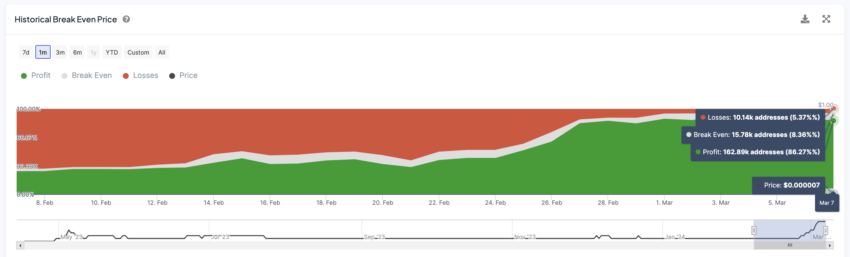

PEPE Profitable Holders Are Worth Watching

Currently, the proportion of PEPE holders making a profit stands impressively at 86%, equating to roughly 160,000 addresses. Just five days earlier, this figure was slightly higher at 91%. Such a dip is expected and normal, given the influx of new holders diving into the market amidst the coin’s bullish momentum.

An interesting point to note is that a high number of profitable addresses might sometimes hint at potential bearish trends. This occurs as numerous holders, having seen their investments grow, might decide to cash in on their gains. Such actions could lead to increased selling activity, ultimately impacting the token’s value negatively.

Nevertheless, the scenario for PEPE appears to lean more towards optimism. Despite the recent price spike attracting new buyers, a significant portion of these investors seem inclined to hold onto their assets. They appear to be aiming for even greater profits, betting on the coin to hit unprecedented highs. This group of holders is likely driven by the belief that they too can join the ranks of profitable investors if they wait out for further price increases.

PEPE EMA Cross Brings A Bullish Signal

The potential for PEPE’s price to continue its upward journey is highly anticipated. Should PEPE successfully surpass the resistance level of $0.0000089, it is poised to embark on a fresh bullish trajectory, potentially reaching the landmark price of $0.00001 in the near future. Achieving this price would mark a historic moment for PEPE, as it would be the first occasion it has attained a price featuring four zeros.

The EMA (Exponential Moving Average) Cross acts as a dynamic indicator, symbolizing the interplay between short-term market sentiment and the confirmation of longer-term trends. On the other hand, moving averages serve to mitigate the volatility of price movements. They offer traders a more transparent insight into potential zones of support and resistance, thus facilitating more informed decision-making.

If PEPE fails to hold above the support level of $0.0000069, there’s a possibility of it descending to $0.000004. This would represent a significant downturn, equating to a 55% correction from its current position.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

[ad_2]

Source link