Market

Bankrupt FTX Creditors at Risk of Phishing Attacks

[ad_1]

FTX creditors are in the crosshairs of phishing attackers, who promise swift withdrawals for trapped assets left after the exchange’s last November collapse. These phishing attempts coincide with revelations that the bankrupt firm had sought financial support from industry giants like BlackRock and Google before its implosion.

On October 20, Sunil, a prominent advocate for FTX creditors, advised FTX creditors not to click on any suspicious links from emails of attackers posing as FTX entities.

Phishing Attack

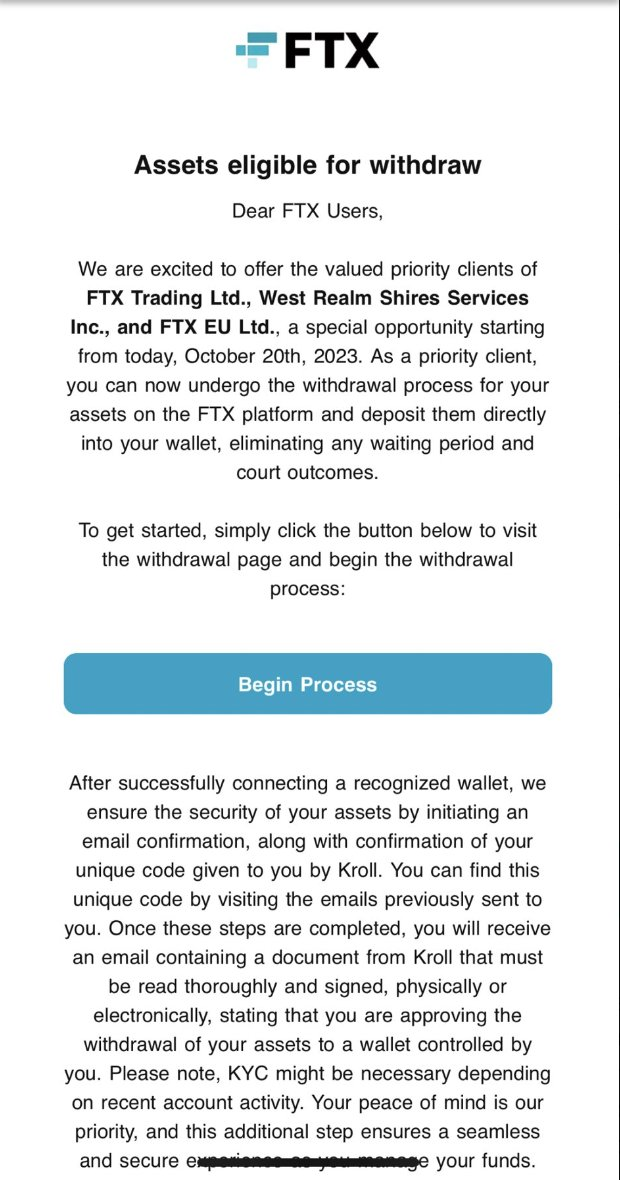

These fraudulent emails promised the creditors expedited withdrawals and encouraged them to transfer their assets to their wallets. These instructions bypass any waiting periods and the current legal proceedings surrounding the bankruptcy processes.

According to the email, “priority clients” can now expedite the asset withdrawal process from the FTX platform. Part of it reads:

“As a priority client, you can now undergo the withdrawal process for your assets on the FTX platform and deposit them directly into your wallet, eliminating any waiting period and court outcomes.”

Meanwhile, this is not the first time FTX’s creditors have been targeted via a phishing scam. In August, the exchange confirmed that its bankruptcy claims agent, Kroll, suffered a breach that compromised customers’ personal information.

It was unclear if the attackers were using the stolen personal information from this incident.

Notably, these phishing attacks occur against pending absolution for FTX creditors. FTX recently proposed a resolution allowing users to potentially recover around 90% of their assets from next year.

FTX Sought Funding from Major Corporations Before Collapse

As the trial of FTX Founder Sam Bankman-Fried unfolds, fresh insights into the company’s management practices and the events leading up to the exchange’s downfall continue to emerge.

Evidence presented during the trial reveals that FTX had actively pursued funding from corporate heavyweights such as BlackRock and Google before its collapse. This funding request coincided with the company’s severe liquidity crisis, eventually leading to its implosion.

The evidence further highlights several rounds of funding efforts by the company, including some that failed to materialize. Notably, in the C1 funding round, FTX had identified 15 potential investors, including BlackRock, Google, and Apollo.

While the company was discussing with Apollo, BlackRock and Google were reportedly conducting their due diligence.

It’s worth noting that BlackRock’s CEO Larry Fink said the asset manager invested $24 million in FTX before it collapsed last year.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link