Bitcoin

Bitcoin Ordinals Filling in Block Space But Miners Are Still Hurting

[ad_1]

Bitcoin ordinals and inscriptions have been a significant buyer of block space this year. Moreover, they have made a positive impact on miner revenue due to increased transaction fees, but dark clouds are looming as the halving approaches.

In its “week on-chain” report on September 26, analytics provider Glassnode delved into whether ordinals and inscriptions were displacing monetary transfers.

Bitcoin Ordinals Filling The Gaps

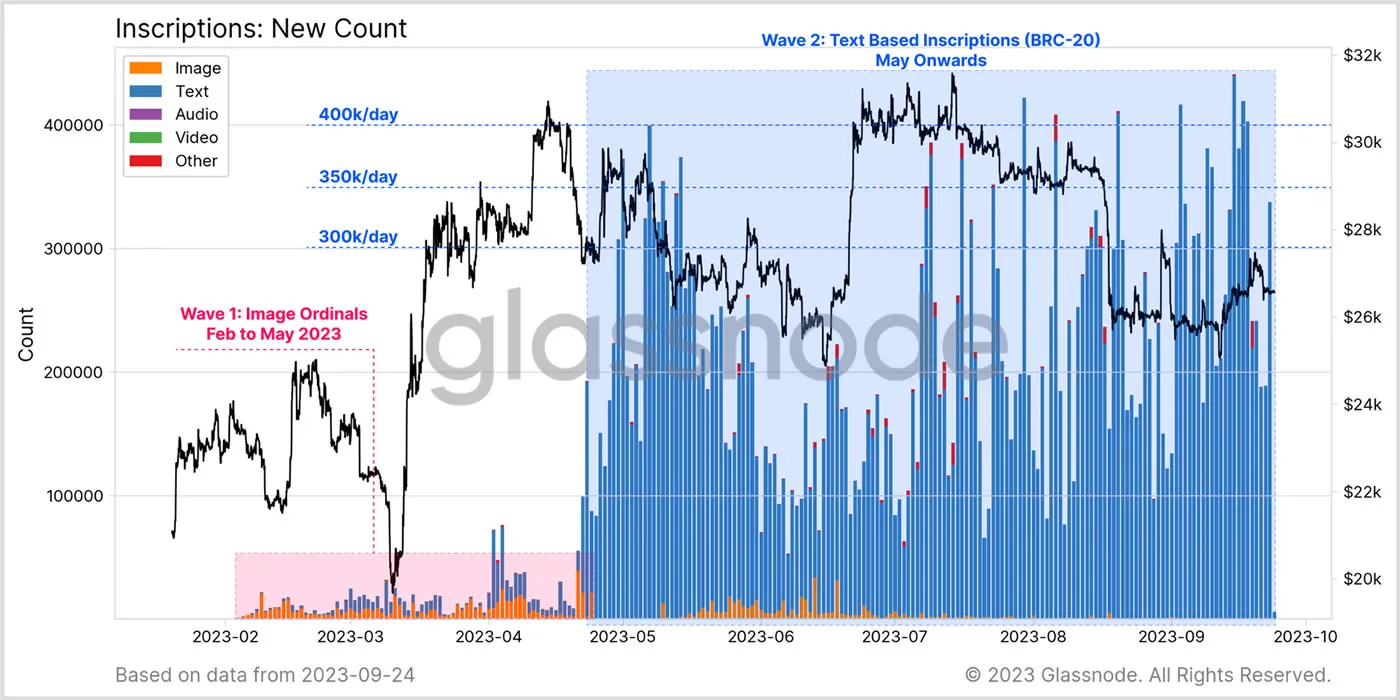

Since their introduction in February 2023, inscriptions have been buying block space and filling up the mempool. It noted that they have been filling in leftover space after higher-value monetary transfers.

However, Glassnode observed that the number of pending transactions in its own mempool has increased significantly since May. It added that most of these unconfirmed transactions have a very small data footprint.

Moreover, inscriptions are sensitive to absolute fee amounts, buying the cheapest block space and getting displaced by urgent monetary transfers.

The explosion of text-based inscriptions aligns clearly with the uptick in pending transactions within our mempool, it noted before adding:

“This confirms that these small-size text inscriptions have become a significant source of demand for blockspace.”

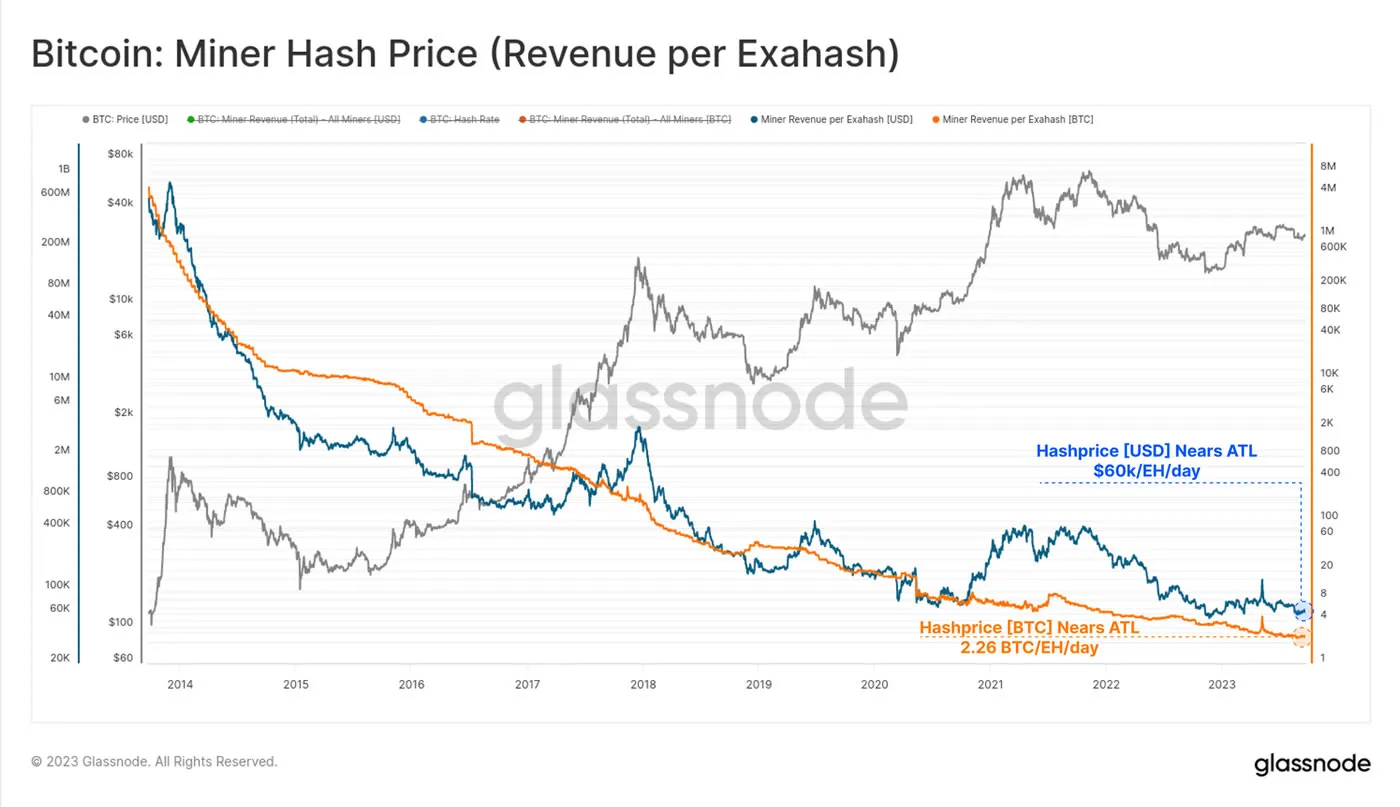

Nevertheless, it is not all good news for miners. Despite increased fees for miners from this new wave of inscriptions, their income is still low overall. This is because the hash price is at an all-time low, and the halving event is approaching.

Hashprice, which is measured in dollars per terahash per second per day, is just $0.059, according to the Hashrate Index. Moreover, this is down 50% from the Bitcoin ordinals pump in May and 85% from the bull market peak of $0.40.

Miners will now earn just 2.26 BTC per Exahash active on the network.

Halving Stress for Miners

As a result, many miners may soon face income stress and unprofitability unless BTC prices rise substantially. The halving in April or May next year will slash their block rewards in half to 3.125 BTC. Glassnode noted:

“The endless logarithmic descent of hashprice shows just how cut-throat and unforgiving the mining industry is.”

The analytics firm concluded that there is minimal evidence that inscriptions are displacing monetary transfers.

“With extreme miner competition in play, and the halving event looming, it is likely that miners are on the edge of income stress, with their profitability to be tested unless BTC prices increase in the near term.”

Meanwhile, BTC prices had retreated to $26,236 during the Wednesday morning Asian trading session.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link