Altcoin

Chainlink Price Prediction: LINK Retests $7 Support

[ad_1]

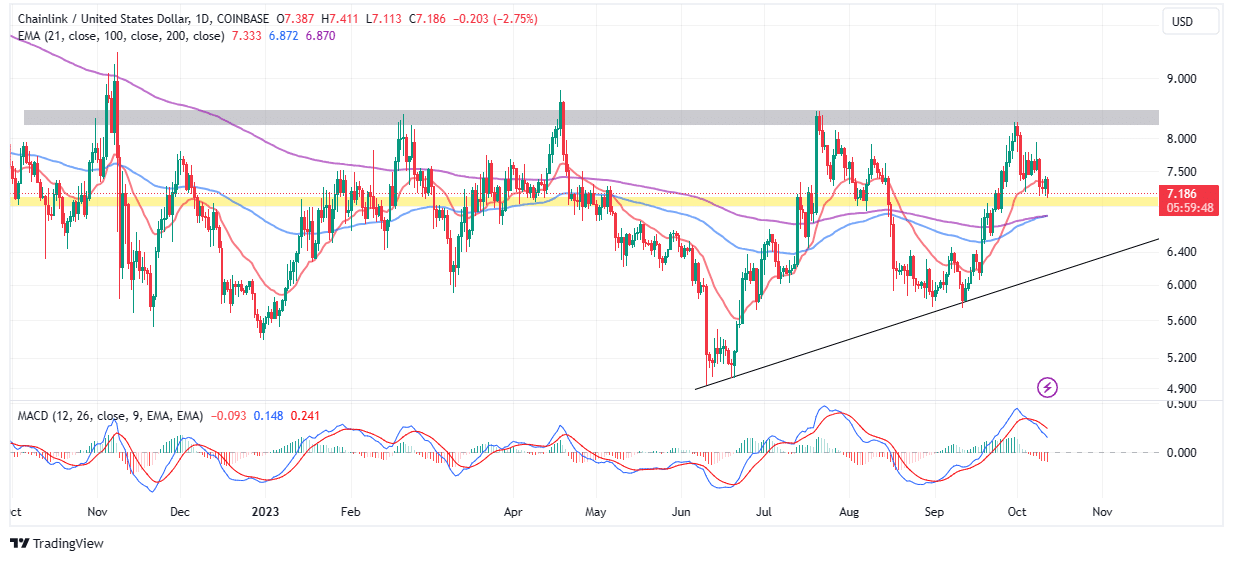

Chainlink outperformed most altcoins in September, posting a 35% rally to $8.2. However, the sharp correction witnessed in October has many analysts wondering if the rally was simply a buy the rumor sell the news narrative.

The largest decentralized blockchain oracle solution protocol ranks #19 among all cryptocurrencies, including stablecoins. It has dipped 5.4% over the last seven days and 2.3% in the last 24 hours.

Trading volume has been on an upward drift as the price dips, revealing a spike in selling pressure. Chainlink price is doddering at $7.16 on Thursday as bulls rush to set camp at $7 in a bid to arrest the bearish situation.

Is Chainlink Price Poised To Resume the Uptrend?

Chainlink’s massive upswing in September had most investors believing that the token would make it above $10. However, a pullback was due, with the resistance it encountered at $8.2. For the uptrend to continue, LINK needed to sweep through lower support areas to collect liquidity.

This support area may be lying at $7 but traders must keep their minds open, considering the Moving Average Convergence Divergence (MACD) reveals a sell signal. This call to sell LINK manifested on October 6 with the blue MACD line crossing below the red signal line.

The 21-day Exponential Moving Average (EMA) (red) limits movement to the upside. Hence, resistance at $7.33 must come out of the way for bulls to fully take control of Chainlink’s movement.

Breaking the immediate support at $7 would imply that bulls extend the search for support to the confluence at $6.8 formed by the 100-day EMA (blue) and the 200-day EMA (purple).

Chainlink Whales Buying The Dip

Blockchain analytics platform Santiment recently reported a 6% increase in the number of addresses with between 100k and 10 million LINK compared to September 18. According to Santiment, following whale activity often portends the direction of the market.

🐳🦈 #Chainlink‘s market value sits at $7.31, trading ahead of most of #crypto over the past 12 hours. Watch where smart money is going, particularly wallets with between 100K to 10M $LINK, which have 6% more addresses in this range compared to Sep. 18th. https://t.co/80kUW3q9Hj pic.twitter.com/kUY9TL9K1J

— Santiment (@santimentfeed) October 11, 2023

Large volume holders could be buying the dip following the jump to $8.2. With interest in LINK rising, the next rebound could be significant and push the token above $10.

Meanwhile, Chainlink is finding itself at the core of the tokenization of real-world assets (RWAs), with investors confident that the protocol’s token LINK could be the “safest bet” when seeking exposure and profiting from the hype.

K33 analyst David Zimmerman said in a recent report “If we wish to have exposure to the RWA narrative and avoid being sidelined when it takes off, LINK is the safest bet.”

Related Articles

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link

✓ Share: