Market

Crypto Trading in Thailand Has Increased, But Wider Issues Loom

[ad_1]

A new report from crypto venture capital firm HashKey Capital has lauded Thailand for being a crypto haven due to increasing trading volume. However, the truth of the matter may not be as simple with crypto payments remaining outlawed in the Southeast Asian nation.

On December 7, HashKey published its Thailand Blockchain Landscape report, declaring the country as the crypto hotspot of 2023.

Thailand Crypto Trading Booming

The report delved into trading volumes totaling $116 billion from January to October 2023.

It also revealed that the average monthly traffic to CoinMarketCap in 2023 reached 648,000, which is around 0.94% of the total population. “Thailand’s per capita visit rate is 0.21% higher than that of the United States,” according to HashKey.

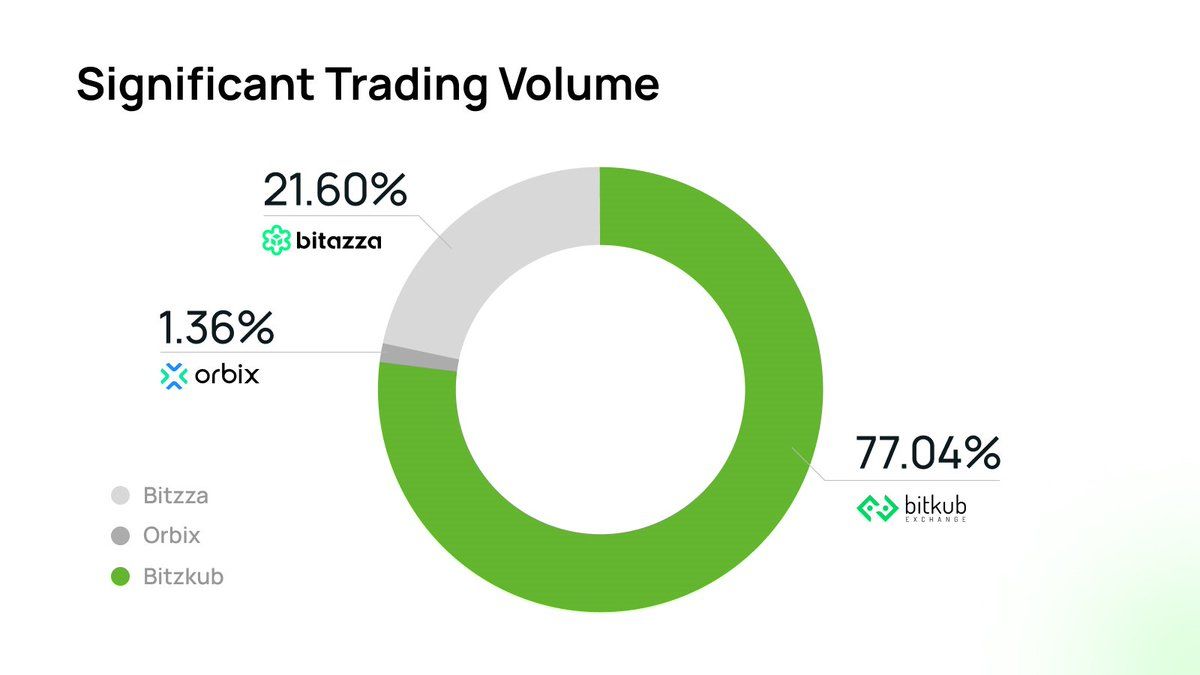

The Bitkub exchange dominates the market with a 77% share. Bitkub has a daily trading volume of around $82 million, according to CoinGecko.

It also reported that Thailand ranked tenth globally in Chainalysis’ Crypto Adoption Index, with 2.94 million crypto exchange accounts.

Read more: Digital Nomads & Web3: A Guide to Traveling the World and Working

While Thai trading volumes appear healthy, the real situation regarding crypto in the Kingdom is not so rosy.

Outside of a handful of niche cafes in the capital Bangkok, and digital nomad hangouts on the tourist islands, crypto is unheard of in the rest of the country. That is hardly surprising considering the ruling junta at the time outlawed crypto payments in March 2022.

The newly appointed government has touted a digital wallet scheme offering handouts to boost the economy. However, this plan is already beginning to come apart as after-election promises start to dissipate, and it faces backlash from opponents.

Taxing Overseas Crypto Trader Income

One of the first things Thailand’s new government did after it took power was to propose a tax on overseas income.

It specifically mentioned stock and crypto traders earning income abroad and bringing it into Thailand. This would hamper the ability of Thais and foreigners to trade crypto on overseas exchanges and bring funds into the country.

HashKey also reported that crypto transactions are currently subjected to a 7% tax. There are “ongoing efforts to reclassify crypto as an investment product, aligning with stocks,” it added. This may result in decentralized digital assets being classified as securities.

Moreover, Thailand’s central bank still remains vehemently anti-crypto. Crackdowns are threatened on a regular basis, leaving the retail sector in a state of limbo regarding the future of the asset class in the Kingdom.

Thailand has seen an uptick in trading, and there are regulations in place for digital asset businesses, but it is not quite the crypto paradise it is made out to be.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link