Market

DeFi Projects Hit $100 Billion TVL, Rival Top 40 US Banks

[ad_1]

The decentralized finance (DeFi) ecosystem is experiencing a significant resurgence, hitting a milestone of $100 billion in total value locked (TVL) for the first time since May 2022.

This surge in TVL reflects growing investor confidence, with more participants trusting decentralized financial platforms with their assets.

Ethereum and Lido Lead DeFi Resurgence

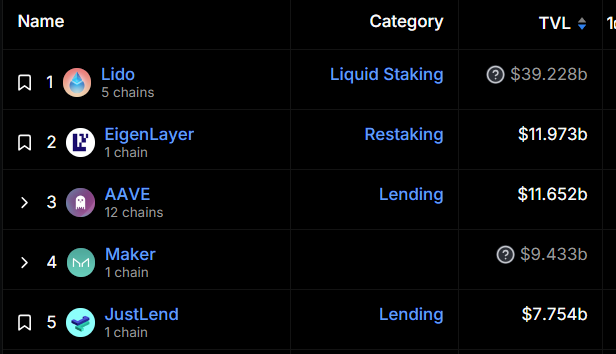

According to on-chain data from DeFillama, the DeFi sector has seen a remarkable 44% increase since January 2024, going from $56 billion to $100 billion. Although this falls short of the previous record of $189 billion set in November 2021, it underscores the escalating interest in DeFi.

Interestingly, at $100 billion TVL, DeFi now ranks as the equivalent of the 37th-largest United States bank, trailing behind Deutsche Bank at number 36 with $110 billion in assets, according to Wikipedia.

Ethereum leads the DeFi space, holding a 59% market share. Protocols operating on its network boast a combined Total Value Locked (TVL) of $56.3 billion. Ethereum’s status fuels this dominance as the premier smart contract platform and a significant surge in ETH’s price, which has risen by over 40% since the year’s outset.

“Ethereum can be seen as a decentralized version of the Apple App Store as it provides the underlying platform for a wide variety of applications. These decentralized applications (called “dApps”) can range from gaming or identity protocols to digital artwork as well as stablecoins and the tokenization of financial assets,” crypto asset management firm Grayscale said.

Meanwhile, the Solana DeFi ecosystem has also experienced notable expansion, evidenced by its TVL milestone surpassing $3 billion.

Lido, an Ethereum-based staking protocol, maintains its position as the largest DeFi protocol with approximately $39 billion TVL, representing a 39% market dominance. On-chain data show that the protocol is on the verge of surpassing 10 million staked ETH.

However, Lido’s dominance faces a stern challenge from EigenLayer, a fast-rising Ethereum-based protocol. This protocol is spearheading the restaking trend, enabling users to utilize their ETH across multiple platforms simultaneously, thereby fortifying security across these networks. This innovative approach significantly reinforces the resilience of smaller and emerging blockchains by tapping into Ethereum’s robust security framework.

“[Restaking is] not only helpful to bootstrap a new network but by allowing to use a new token that lives in Ethereum to secure another network you allow a new L1 to access directly all the liquidity from Ethereum. This is huge for censorship resistance and avoiding weird deals between new L1s and CEX,” RJ, the founder of Yet Another Company explained.

Notably, EigenLayer’s TVL has witnessed a remarkable surge, particularly over the last 30 days. Starting from around $2 billion at the beginning of the previous month, it has soared five-fold to its current level of $11 billion.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

[ad_2]

Source link