Ethereum

Ethereum Dive To 3-Year Low Against Bitcoin, Is This A Bear Trap? Trading Guru Weighs In

[ad_1]

Trading Guru Peter Brandt has recently commented on the Ethereum vs. Bitcoin chart, offering intriguing insights into market developments.

Brandt’s remark comes after his prior critiques of Ethereum, denigrating it as a “junk coin” and its proponents as “Etheridiots.” However, amidst Ethereum’s recent descent to its lowest position against Bitcoin in nearly three years, Brandt’s stance seems to have transformed.

Ethereum Plunges Against Bitcoin: A Bear Trap?

Upon analyzing the Ethereum-to-BTC chart, Brandt suggested the presence of a “bear trap,” indicating that the ongoing decline in Ethereum’s value compared to Bitcoin might entice sellers into additional short positions.

However, this could lead to an unexpected reversal, turning the apparent breakdown in support into a false signal.

Bear trap? That is always a possibility when price hits a new 35-month low. pic.twitter.com/aKQg9k7TcD

— Peter Brandt (@PeterLBrandt) April 8, 2024

Brandt’s observation of a potential bear trap highlights the complexities within the cryptocurrency market and the importance of considering multiple factors when analyzing price movements.

While Ethereum may be experiencing a period of relative weakness against Bitcoin, Brandt’s cautious optimism suggests that there may be opportunities for a reversal shortly.

Bullish Signals Amid ETH/BTC Downturn

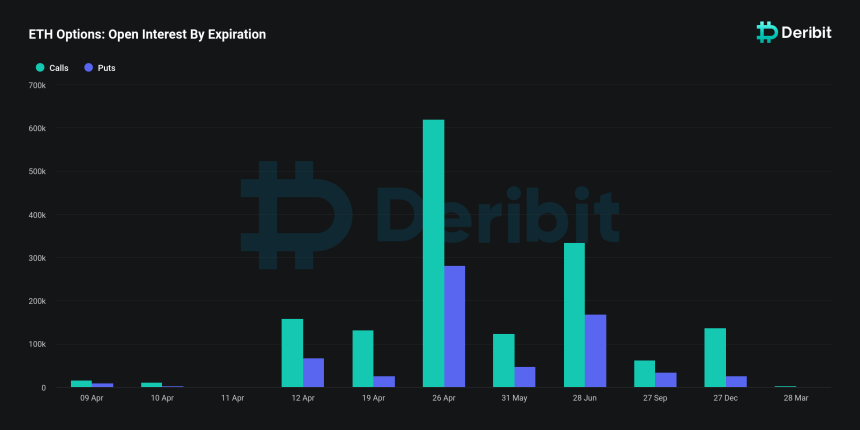

Despite Ethereum’s recent challenges, bullish signals have emerged, hinting at a potential turnaround. The options market, in particular, has shown optimism, with a significant portion of Ethereum options open interest expiring by the end of April being bullish bets on price.

Deribit data reveals that about $3.3 billion worth of notional ether options are scheduled to expire, with approximately two-thirds of this sum allocated to calls. Moreover, the Ethereum put-call ratio for the April expiration stands at 0.45, signaling a slightly more bullish stance than Bitcoin options.

Notably, a put-call options ratio below one suggests bullish sentiment, with traders favoring call options over put options. Moreover, the emergence of two new Ethereum whales, according to the crypto tracking platform Spot On Chain, identified as 0x666 and 0x435, adds to Ethereum’s bullish sentiment.

These entities collectively withdrew a substantial amount of ETH from a major exchange, suggesting growing confidence in Ethereum’s prospects despite its recent downtrend.

While Ethereum faces downward pressure against Bitcoin, Bitcoin’s resilience in the market is evident. Crypto analyst Ali has highlighted that Bitcoin appears to be breaking out, with a potential upside target of $85,000 if it can hold above $70,800.

#Bitcoin appears to be breaking out! If $BTC can hold above $70,800, the next target becomes $85,000! pic.twitter.com/JPLf18KZvt

— Ali (@ali_charts) April 8, 2024

When writing, Bitcoin trades above this critical level with a current market price of $71,621, indicating a possible climb towards $85,000 shortly.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link