Market

Here Is What Morgan Stanley Predicts for Crypto in 2024

[ad_1]

With rapid technological advancements and shifting geopolitical landscapes, the global financial system stands at a crossroads. The dominance of the US dollar faces challenges from emerging cryptos like Bitcoin.

Morgan Stanley offered a nuanced perspective on the future of crypto in 2024, particularly in the context of new financial trends.

Cryptocurrencies to Disrupt the Financial System

Despite the US contributing about 25% to global GDP, the US dollar remarkably constitutes nearly 60% of global foreign exchange reserves. This disproportionate influence, however, is under scrutiny.

Nations are increasingly diversifying their monetary reserves in response to US monetary policies and the strategic use of economic sanctions. The European Union and China are at the forefront of this shift, seeking to enhance the euro and yuan’s roles in international trade.

Read more: Crypto vs. Banking: Which Is a Smarter Choice?

Concurrently, the cryptocurrency market is witnessing exponential growth. Bitcoin has evolved from an internet forum idea to a sovereign reserve asset. With a market capitalization rivaling the GDP of major economies like Switzerland and its adoption by countries like El Salvador and the Central African Republic, Bitcoin’s influence on the global financial stage is undeniable.

“The adoption of Bitcoin beyond speculative purposes continues to evolve. U.S. regulators in January gave the green light to BlackRock and 10 other asset managers to offer spot Bitcoin exchange-traded funds (ETF), a potential paradigm shift in the global perception and use of digital assets,” Andrew Peel, CFA Executive Director Head of Digital Asset Markets at Morgan Stanley, wrote.

Meanwhile, stablecoins have seen staggering adoption, particularly those pegged to the US dollar. These assets processed transactions close to $10 trillion in 2022. This growth indicates their rising importance in the digital asset space, facilitating efficient, 24/7 trading and near-instant settlements.

For this reason, Visa has integrated Circle’s USD stablecoin (USDC) on Solana, and PayPal introduced its PayPal USD (PYUSD), reflecting a significant shift in embracing blockchain technology.

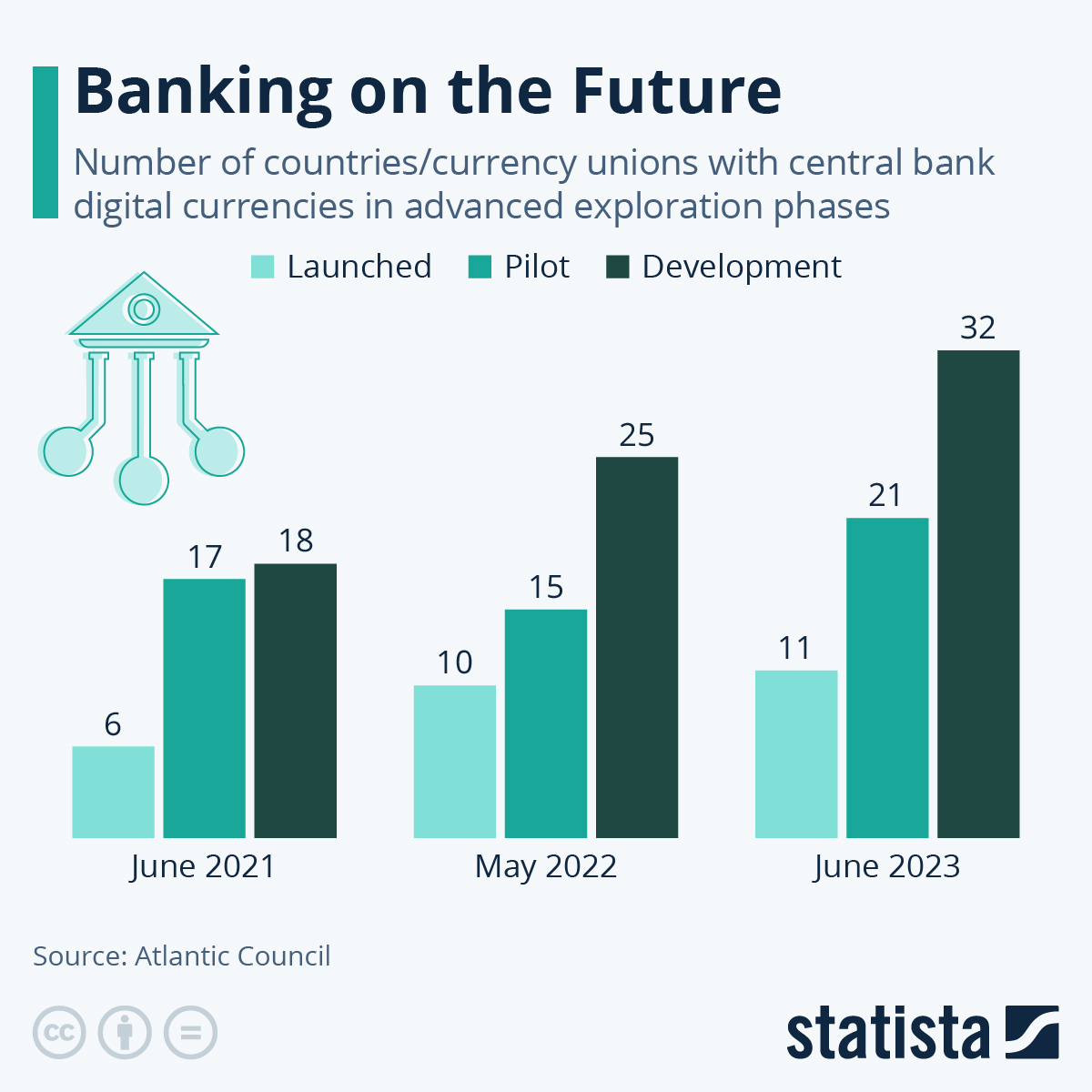

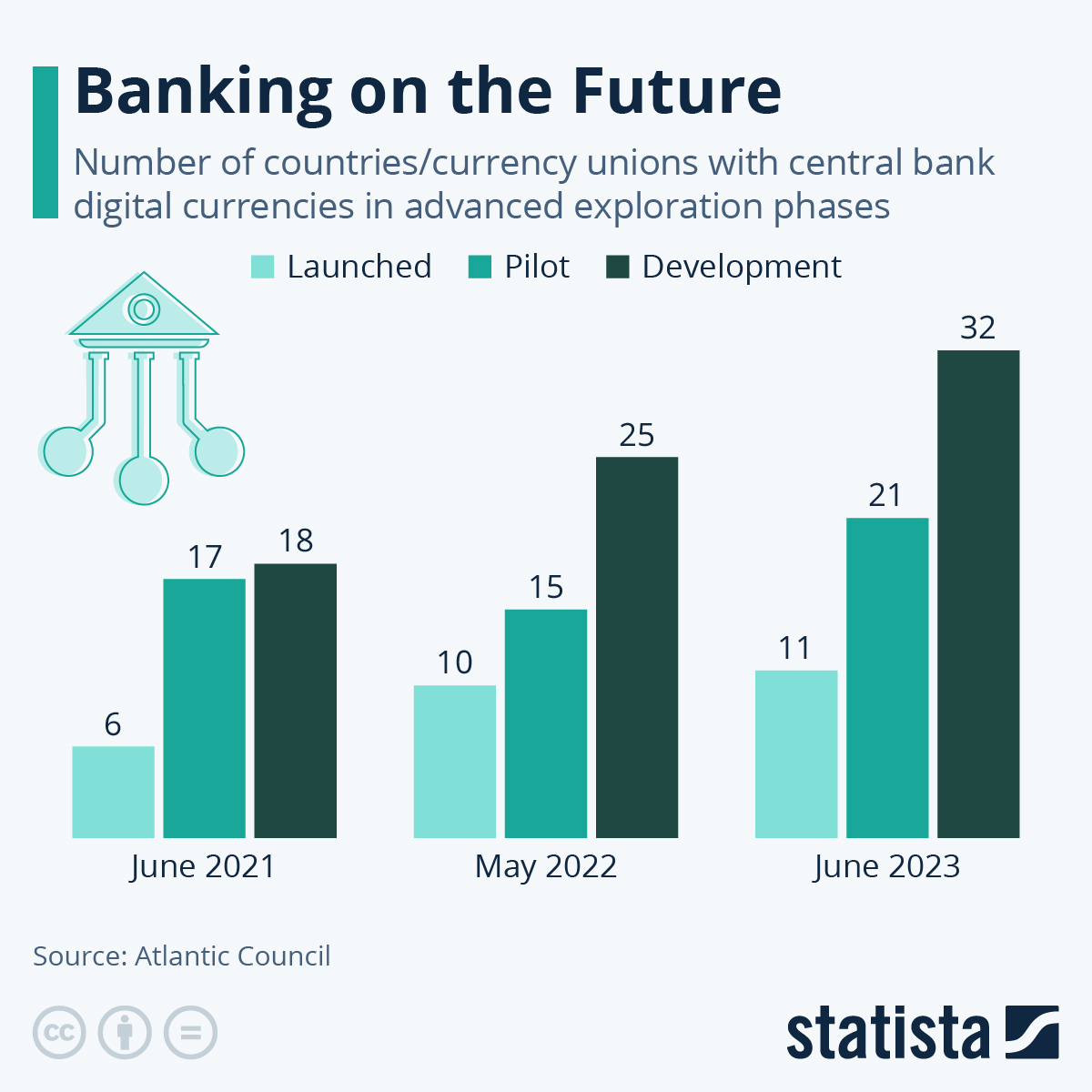

The rapid adoption of stablecoins has also catalyzed interest in Central Bank Digital Currencies (CBDCs). As of mid-2023, over 95% of global GDP is represented by countries actively exploring CBDCs. Unlike decentralized cryptocurrencies, these digital currencies offer centralized control over monetary systems, promising efficiency and innovation in financial services.

For instance, the introduction of China’s digital yuan and Brazil’s plans for a digital currency initiative, DREX, exemplify this trend.

Morgan Stanley Predicts the Future of Crypto

Morgan Stanley’s analysis underscores that these advancements in cryptocurrencies — Bitcoin, stablecoins, and CBDCs — are reshaping the financial system. Understanding the implications of these developments on global financial stability and monetary policy is crucial for macro investors. Indeed, the adoption of digital currencies signifies a shift in global economic power dynamics.

In this context, the roles of Bitcoin and stablecoins are especially significant. Bitcoin’s widespread adoption, including its use as legal tender in El Salvador, reflects its growing legitimacy. Stablecoins, with their utility in cross-border transactions and value storage, are set to impact how money is moved globally.

“While changes in global trade and currency usage are likely to be gradual during the early adoption stages of these digital solutions, they are expected to gain mainstream acceptance over time… As the world adjusts to these technological advancements, understanding the interplay and nuances between traditional fiat currencies, Bitcoin, E-Money, and stablecoins becomes crucial,” Peel concluded.

Likewise, the emergence of CBDCs presents opportunities and challenges. These digital currencies promise greater efficiency in financial transactions and potential financial inclusion. However, they also necessitate careful navigation of the implications for privacy, security, and monetary sovereignty.

Read more: Digital Rupee (e-Rupee): A Comprehensive Guide to India’s CBDC

Morgan Stanley’s outlook for 2024 portrays a nuanced scenario where cryptocurrencies play a crucial role in reshaping the global financial system. The key lies in staying informed and adaptable to leverage the opportunities presented by these transformative financial technologies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link