Market

Hong Kong Spot Bitcoin ETFs Attract Chinese Giants

[ad_1]

Two of China’s investment giants, Harvest Fund and China Southern Fund, are reportedly pursuing spot Bitcoin exchange-traded funds (ETFs) in Hong Kong.

This move coincides with decreasing investor interest in US spot Bitcoin ETFs, as evidenced by decelerating weekly inflows.

Chinese Investment Giants Set Sights on Hong Kong Bitcoin ETFs

Securities Time reports Hong Kong subsidiaries of both Harvest Fund and China Southern Fund are actively participating in the Bitcoin ETF application process. Additionally, they are engaged in the deployment process.

Harvest Fund, in particular, has submitted a proposal for a spot Bitcoin ETF with the Hong Kong Securities and Futures Commission (SFC). Additionally, China Asset Management’s Hong Kong arm has partnered with a Hong Kong-based Bitcoin ETF custodian.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Industry analysts predict these applications could gain approval as early as the second quarter 2024. With $230 billion and $280 billion in managed assets, respectively, Harvest Fund and China Southern Fund would significantly elevate participation in Bitcoin-related investment products.

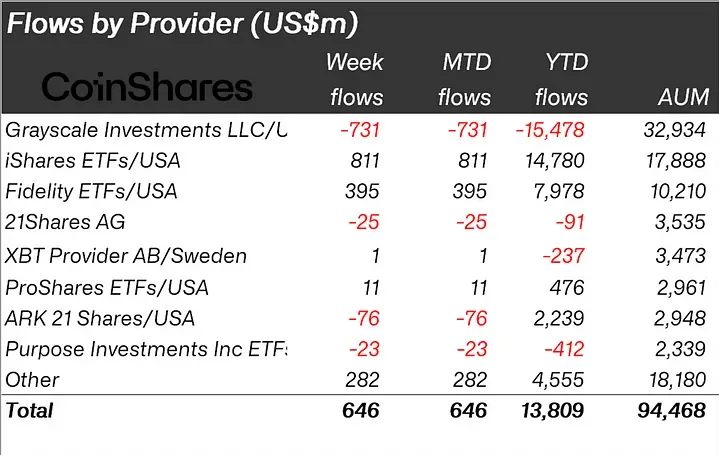

The timing aligns with a report from CoinShares noting “signs of ETF hype moderating.” Last week, the inflow of digital asset investment products, including US-approved spot Bitcoin ETFs, amounted to only $646 million. This number reflects a decrease from $862 million two weeks earlier.

Despite this short-term dip, year-to-date inflow figures for digital asset investment products show growth. Two weeks ago, the total inflow stood at $13.14 billion; last week, this rose to $13.81 billion.

Applications for spot Bitcoin ETFs in Hong Kong by reputable Chinese funds could be a bullish signal. Hong Kong’s determination to establish itself as a crypto hub, plus its unique relationship with China, hints at a potential softening of China’s overall crypto stance.

This could have far-reaching positive implications for crypto markets. Moreover, key industry figures have praised Hong Kong’s regulatory clarity.

Yet, Hong Kong’s autonomy under the “One Country, Two Systems” agreement with China will expire in 2047. This raises questions about the long-term sustainability of Hong Kong’s favorable regulatory environment.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Bobby Lee, Ballet founder and CEO, expressed this concern during an August 2023 interview with BeInCrypto. Lee questioned the pace of Hong Kong-China integration over the next 23 years, highlighting the eventual unification of currencies and systems and, potentially, surveillance under a single framework.

“The question is: what would happen in the next five years [in Hong Kong]? The next 10 years? The next 20 years? Or, even the next 24 years? Would it change? I think [Hong Kong’s regulatory environment] would change,” Lee stated.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link