Altcoin

Loom Network Price Prediction As LOOM Pumps 28%

[ad_1]

Loom Network is outperforming the rest of the crypto market to hit levels last seen in 2018. The token, built on the Ethereum blockchain to support large-scale decentralized applications, has in the last 24 hours increased by 28%, bringing the total accrued gains to 43% in one week, 109% in two weeks, and 527% in 30 days.

Traders are finding a haven in LOOM, with $643 million in trading volume rushing in—up 208%, according to market data by CoinMarketCap. The Loom Network market cap is also on an upward trajectory, growing by 27% to $332 million. The token ranks #89 among other cryptos including stablecoins.

Loom Network Price Prediction: Rally Shows No Signs Of Slowing Down

Traders are finding excellent scalp opportunities in LOOM with the token soaring even further on the MEXC exchange. The short-term bursts allow for new entries for buying and selling the digital asset on short-term periods for small but meaningful profits, considering the lock-step movements exhibited by prominent cryptos.

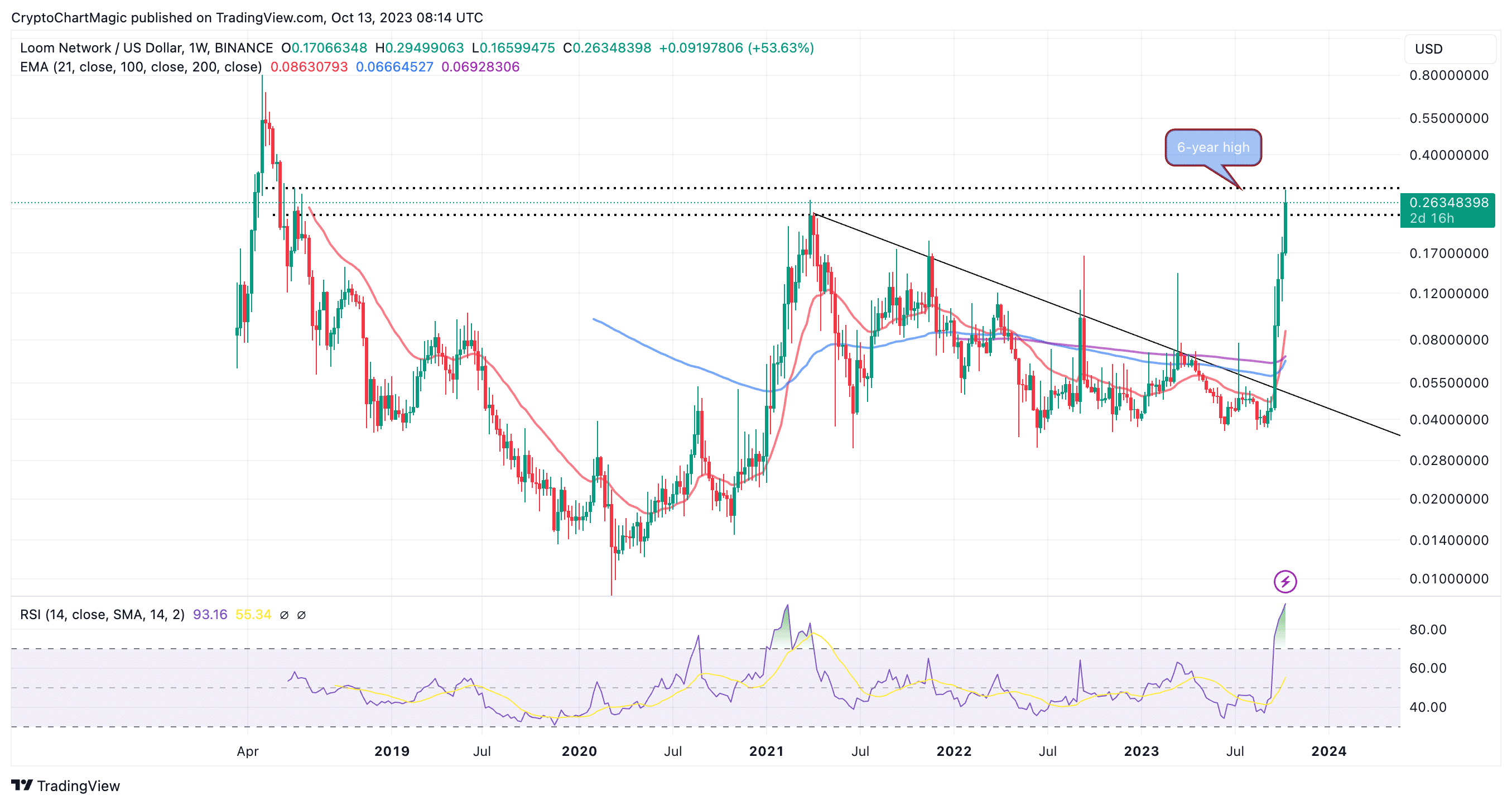

The Moving Average Convergence Divergence (MACD) indicator’s upward trajectory affirms the bullish outlook. Traders may want to keep speculating with longs as long as the MACD stays above 0.02. However, caution is advised considering the Relative Strength Index (RSI) at 93 is highly overbought.

Multiple golden cross patterns back the uptrend. A golden cross occurs when a short-term moving average flips above a long-term moving average reinforcing the bullish grip and a high probability of prices sustaining the rally. In LOOM’s case, the 21-day Exponential Moving Average (EMA) (red) is holding above both the 100-day EMA (blue) and the 200-day EMA (purple).

Loom Network’s remarkable rally is a relief to traders who have been battered by the bear market. However, investors should consider booking profits to secure the gains ahead of an imminent correction, especially if resistance at $0.3 fails to budge.

LOOM sits on top of local support at $0.17. Holding above this level could help secure the uptrend while allowing more traders to jump in. Aggressive sellers will take the reins if the token slides below this support, which might push LOOM to the next key area at $0.11 and if declines intensify to $0.07.

LOOM Tops Upbit’s Top Gainers List

Korean exchange Upbit has ranked LOOM token the biggest gainer, a move that is raising questions, considering the region is known for regularly pumping and dumping cryptos.

Upbit N01 bag is not #Btc , #Eth or Stables. It’s $Loom lol 😂

▪️They specialize in pumping dead projects.

👉Which token is next on their to-do-list ? 🤔#DYOR 🕵🏼♂️ https://t.co/GdRYlOa8zH pic.twitter.com/VbqZImSIWR— Marius.capital (@AltbriMarius) October 12, 2023

Korean traders are notorious for pump-and-dump schemes. According to CryptoQaunt CEO Ki Young Ju, their actions are understandable because South Korea has imposed strict capital controls, prohibiting all “arbitrage opportunities between global exchanges.”

Fun Fact 3.

Korean crypto traders love pumping & dumping altcoins, ironically. Got this clip from my Korean friend. pic.twitter.com/63Ewssu5VO

— Ki Young Ju (@ki_young_ju) March 30, 2023

Meanwhile, speculations are thawing regarding the possibility of Upbit launching a LOOMWON trading pair. This comes on the backdrop of support for the REI token following the hardfork update.

Related Articles

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link

✓ Share: