Altcoin

Over $15B in Bitcoin and Ethereum Options Expiry, Big Crypto Rally or Crash?

[ad_1]

Major events for the crypto market on Friday will determine the direction of the market in the next coming days, ahead of Bitcoin halving. The crypto will witness the largest Bitcoin and Ethereum options expiry, leading crypto derivatives exchange Deribit to settle over $15 billion in BTC and ETH options.

Moreover, the U.S. Bureau of Economic Analysis will release the U.S. Federal Reserve’s (Fed) preferred inflation gauge PCE and core PCE. Experts estimate inflation to cool further but, the annual value may shock the market. U.S. Federal Reserve Chair Jerome Powell to also speak on macroeconomics and monetary policy on March 29.

Bitcoin and Ethereum Options Monthly and Quarterly Expiry

Traders are bracing for monthly and quarterly expiry, which is the largest crypto expiry in history. The Crypto Greed and Fear Index has dropped to 80 (extreme greed) from 83 in the last 24 hours, indicating a drop in buying before expiry and PCE inflation data.

Deribit said this Friday marks one of the biggest expiry in crypto derivatives exchange’s history as $9.5 billion BTC options open interest out of $26.3 billion will expire. Moreover, $5.7 billion ETH options open interest out of a total of $13.2 billion will expire on March 22 at 8:00 AM UTC. The market could see massive buying during post-expiry, with traders eyeing a new all-time high for BTC and ETH prices.

Furthermore, $465 million in BTC March Future and $230 million in the March ETH future will expire, which is approximately $700 million of $1.9 billion.

Notably, 135K BTC options of notional value $9.5 billion are set to expire, with a put-call ratio of 0.85. The max pain point is $51,000, indicating massive volatility is expected amid huge delivery and reshuffling of positions. Volatile price movements are always expected during options expiry, but positive sentiment to likely drive upward momentum in BTC price to $75K.

BTC price currently trading at $71,200, up 2% from the 24-hour low of $68,381.

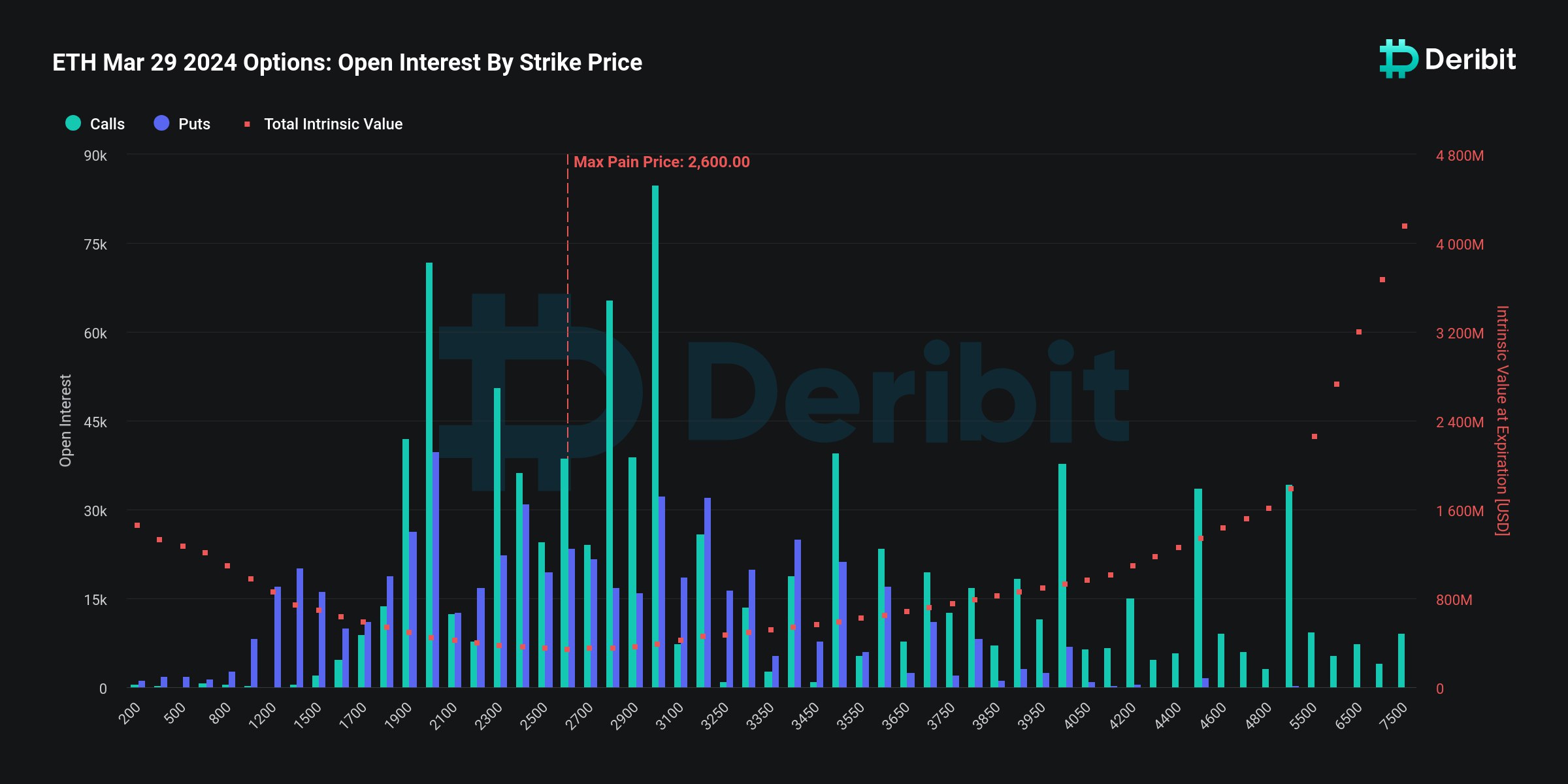

Moreover, 1,575K ETH options of notional value of almost $5.6 billion are set to expire, with a put-call ratio of 0.63. The max pain point is $2,600, which is also higher than the current price of $3,560. Traders must keep an eye on drastic changes in trading volumes for confirmation on recovery or fall in ETH prices.

Meanwhile, the call volume is higher than put volume ahead of the major expiry day, with the put/call ratio of 0.68. ETH price trades at $3,581, up 3% from a 24-hour low of $3,460.

GreeksLive market researcher Adam in a post on X said the hedging costs of market makers have increased significantly as compared to last week, with positions also accelerating. He added that the Matthew effect of trading enthusiasm is also an influencing factor for fluctuations in trading during US hours.

Read More: Bitcoin Option Selling Likely Before Quarter End, BTC Price Rejected At $72,000

Can a Rally Start Immediately After Expiry?

Investors expecting a rally in the crypto market will be disappointed as the PCE inflation data and Fed Chair Jerome Powell’s speech will likely exert pressure on the BTC price.

In the last bull market, Deribit saw its largest expiry of 100K BTC options of notional value of $3.1 billion. BTC price crashed after the expiry. However, demand from spot Bitcoin ETFs will help reduce some impact of the options expiry.

We are far away from the “Max pain” price for both $BTC & $ETH. These are usually the levels at which option sellers try to pin prices in the spot market to inflict losses on the buyers.

With the expiry settling the Q1 options, dealers will close out their hedges and stop…

— Nic (@nicrypto) March 28, 2024

Analyst Michael van de Poppe said Bitcoin is holding above crucial levels and another ATH is expected if it stays above $67K. “Overall, upwards returns seem relatively skewed for Bitcoin pre-halving.” Correction in BTC price is expected to be immediately bought by whales and investors.

Top analyst Markus Thielen is bullish on Bitcoin price rising above $100K and reaching $140K after the bitcoin halving. However, he also warned that it may nullify if Bitcoin trades below $68,000 due to market volatility before the month’s end.

Also Read:

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link

✓ Share: