Market

Why Did Steve Christie Return to Crypto Exchange Binance?

[ad_1]

Steve Christie, previously the Senior Vice President of Compliance at Binance, has rejoined the cryptocurrency exchange in the capacity of Deputy Chief Compliance Officer (DCCO).

Meanwhile, this move comes in the wake of the regulatory challenges Binance has recently faced, including a substantial settlement of $4.3 billion with United States regulators over alleged penalties.

Steve Christie Returns to Binance

Christie expressed satisfaction with how Binance addressed the regulatory challenges from the United States Securities and Exchange Commission (SEC) and the US Department of Justice (DoJ).

“I am impressed by what Binance has accomplished on the compliance front since I stepped away momentarily.”

According to the statement, Christie and Binance’s Chief Compliance Officer, Noah Perlman, will collaborate to further strengthen its global compliance program.

However, Christie and Perlman will also bolster new opportunities for Binance to maintain a leadership role as the industry evolves.

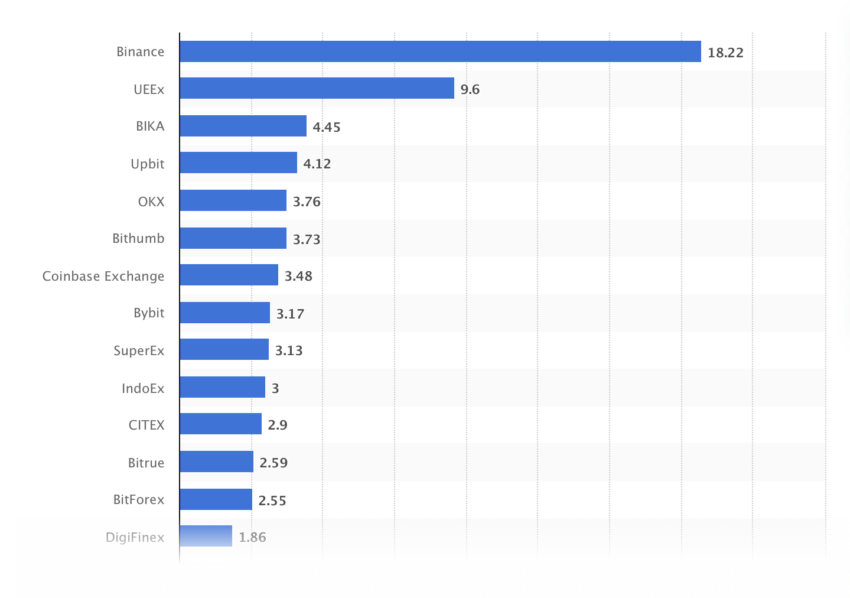

Statista’s recent data highlights Binance as the frontrunner in 24-hour trading volume among global cryptocurrency exchanges. As of January 9, Binance recorded a trading volume of 18.22 billion.

Read more: Top 7 Binance.US Alternatives That Support USD Withdrawals

Binance’s Recent Regulatory Troubles

In December 2023, BeInCrypto reported the court declared that Changpeng “CZ” Zhao and Binance allegedly violated the Commodity Exchange Act and CFTC regulations.

This resulted in a $150 million civil monetary penalty against Zhao personally.

Read more: Top 7 Binance Card Alternatives Available in Europe

In November 2023, Binance and CZ agreed to settle with the US Department of Justice for a $4.3 billion penalty.

The deal included a $3.4 billion penalty from the US Treasury’s Financial Crimes Enforcement Network. Additionally, another $968 million from the Office of Foreign Assets Control.

However, its lawsuit against the US Securities and Exchange Commission (SEC) is still ongoing.

The SEC initiated legal action against Binance in June 2023, accusing Binance Holdings Ltd., its U.S. subsidiary BAM Trading Services Inc., and the company’s founder, Changpeng Zhao, of multiple violations.

On Jan. 19, Binance requested to the court that the SEC lawsuit be dismissed.

More recently, CZ was denied his travel request back to the United Arab Emirates. He must stay in the US until his sentencing date later this month.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link