Market

Why SEC Demands Ripple Sales Data Despite Court Ruling

[ad_1]

The US Securities and Exchange Commission (SEC) has requested Ripple Labs’ financial statements for 2022 and 2023. The company has asked for an extension to comply with the request.

The SEC also requested the contracts Ripple used to sell XRP to institutional investors after the July 2023 court ruling. At that time, US Judge Analisa Torres ruled that Ripple’s sales of XRP to institutional investors were unregistered securities offerings.

SEC Wants Financial Statements to Deter XRP Sales

The agency alleged that despite the judge’s ruling in July, Ripple still sold XRP to institutional investors. The SEC alleges that Ripple incorrectly said in its July report that the judge’s ruling did not apply to the transactions it did with overseas clients. Hence its requests for post-ruling institutional agreements.

Read more: Everything You Need To Know About Ripple vs SEC

The SEC said the documents will help Torres decide whether to impose civil penalties on Ripple Labs and how much those penalties should be. The documents could also deter future violations.

“Ripple’s current financial condition and the actual total amount it received from its violative Institutional Sales is fundamental to tailoring a penalty to deter future violations.”

Ripple Labs filed a Motion for Extension of Time to delay its submissions until Jan. 19, 2024. The company has yet to comment on the issue publicly.

Ripple Refutes XRP Market Dump Allegations

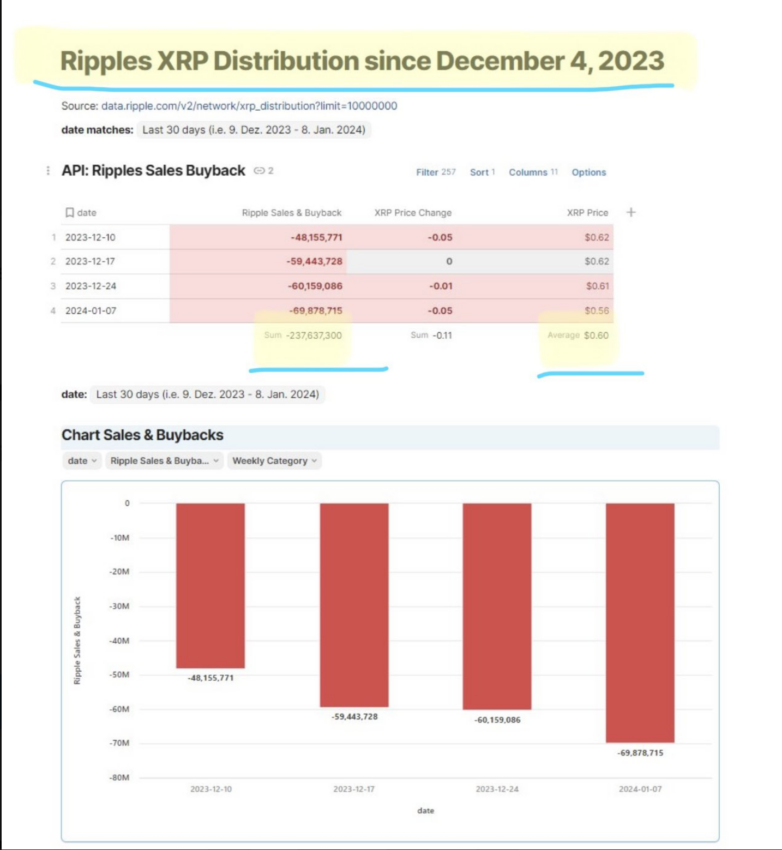

The SEC’s requests come as the company refutes claims it sold XRP en masse in December. A researcher with the X handle “3TGMCrypto” claimed that Ripple sold 327 million XRP, almost three times their usual monthly tally. Ripple’s CTO David Schwarz refuted such claims, saying the sales figures would be presented in the company’s upcoming market report.

“We have always tried to be transparent about our holdings, even when that transparency has been used against us.”

However, the claims by 3TGMCrypto could explain why the SEC is requesting Ripple’s post-ruling contractual agreements. It could also explain why XRP’s Relative Strength Index was neutral in December last year. A neutral rating suggested the asset could either break out or break down.

Over two-thirds of respondents to 3GTMCrypto’s allegations agreed Ripple’s XRP selling could be suppressing the asset’s price. The asset is currently priced at $0.598.

Read more: How To Buy XRP and Everything You Need To Know

Do you have something to say about the SEC’s request for Ripple’s financial statements or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link