Regulation

XRP Lawyer Predicts Blackrock’s Coinbase Equity To Rise

[ad_1]

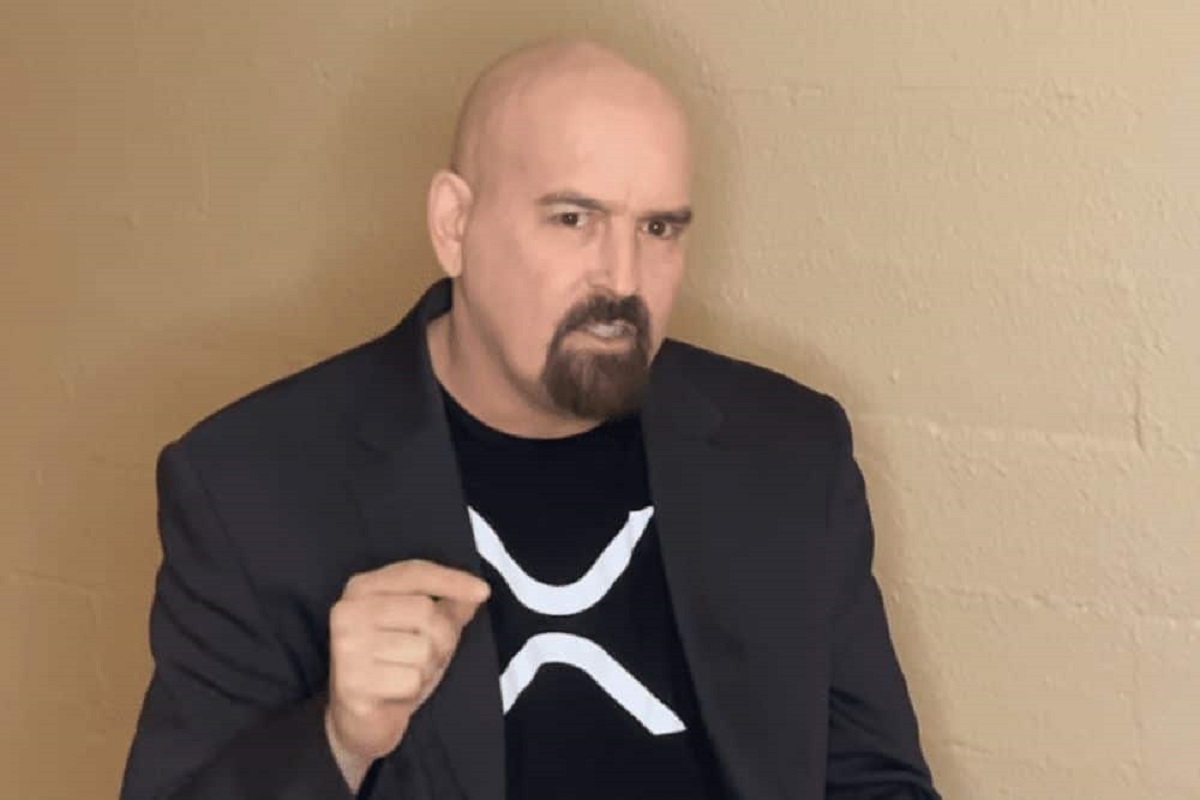

John Deaton, the attorney who represents the thousands of token holders in the XRP lawsuit, made a prediction about Blackrock’s equity investment in crypto exchange Coinbase. This comes at a time when a majority of spot Bitcoin ETF applicants with the US Securities and Exchange Commission (SEC) plan to use Coinbase for custody services if and when the ETF filings are approved.

Also Read: SEC Seeks Public Input on Franklin Templeton’s Bitcoin ETF

Coinbase’s Institutional Backing

While Coinbase could potentially be in a formidable position come the spot Bitcoin ETF approval, the many institutional investors in the company would stand to benefit from the US SEC approval. According to Nasdaq data, the likes of Blackrock, Vanguard, Morgan Stanley and Cathie Wood’s ARK Investment are among the top companies that hold shares in the US based crypto exchange.

Among the 682 institutional holders invested in the company, Vanguard Group alone owns as much as 13.21% of shares while Blackrock owns 7.82% of shares. Also, the exchange could have an added advantage of managing the potential spot ETF custody services.

John Deaton Says Blackrock To Gain More Of $COIN

Attorney Deaton believes investment management giant Blackrock could likely look to improve on its existing shareholding position in Coinbase ($COIN). This could be supported by the dominance of $COIN as a custodial services provider among the long list of financial companies aspiring to get the spot Bitcoin ETF filing approved. The XRP lawyer predicted that the Blackrock equity in Coinbase could go up in the context of its pole position as preferred custodian for the likes of Blackrock, Grayscale, WisdomTree and Valkyrie.

The attorney had long been arguing that the incumbent financial giants were looking to gain a significant market share in crypto ecosystem before the regulators introduced full fledged crypto guidelines.

Also Read: USTC Soars 15% Amid LUNC’s Recovery Post BTC Surge

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link

✓ Share: